Financial Services for Farmworkers: A checkered past and a brighter future

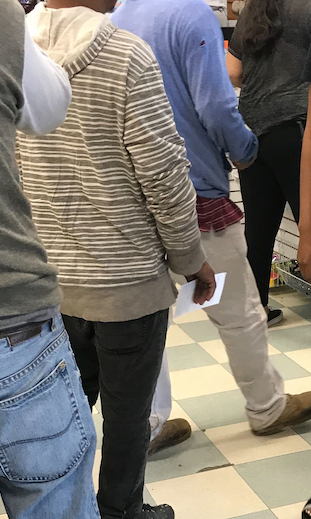

It was a hot summer afternoon in Quincy, WA. Tumbleweed bounced down the streets as buses of farm workers rolled into town. It was Friday--payday. I had just spent the afternoon with a customer getting their feedback on our tools and discussing the future of Ganaz--financial services for workers. I stopped at a grocery store to get a snack, and masked workers were pouring out of the buses, bearing paper paychecks and dusty boots from their hard work in the orchards.

The line at the check cashing store nearby snaked out the door and onto the curb, following any scrap of shade that could be found. This particular store charged 1.5 percent of the paycheck, relatively typical for check cashing. An average check for a week’s work in eastern Washington is about $700, so the workers spend $10.50 just to get access to their money. $10.50 is 45 minutes of work under the baking sun, 450 pounds of apples picked, 15 times up and down the ladder.

Once workers cash their paycheck, they often hand some of that money back to the store clerk to send it to their family in Mexico. If they are H2A visa workers, they send about 85 percent of their money home. If they are locals who have lived here for a while, they may only send 15 percent of their money back to Mexico (or other countries). The fee to send that money is typically 5 percent or more. An H2A visa worker, then, spends two hours picking apples (more than half a ton of fruit, 40 times up/down the ladder) each week just to pay for the money transfer fees. A local worker spends about 45 mins each week working to pay Western Union and the like.

This all adds up to a massive transfer of wealth from workers to financial institutions.

With $50B in payroll in food & agriculture being paid out mostly in paper checks, $750M of hard-earned wages is being lost to check cashing services

We estimate that up to $5B of the wages earned in food & agriculture is sent to their families in Mexico via remittance services. Most of this is being sent through store-front locations, and represents a sizable share (about 14%) of the total remittances flowing from the US to Mexico. If we assume an average of 5 percent fee, that represents $250M in fees

Payday lending and bank overdraft fees are other common--and even more expensive--financial tools that workers rely on to get by from paycheck to paycheck

Business is booming for companies serving low income, unbanked and underbanked populations. According to the Financial Health Network, the approximately 100 million low income Americans that rely on these services pay nearly $200B in fees each year. That’s $2000 per year per person, for folks that might make only $20-30K per year.

Introducing the Ganaz Mastercard® Payroll Card

So what is Ganaz doing about this gap in fair financial services? As Ganaz grows our reach--with 125,000 workers on the platform and thousands more added every month--we’re also deepening the services we offer to employers and workers. We have an opportunity to expand our theory of change:

We believe that by providing technology that makes it easy to be a great employer, workplaces will be safer, happier places to be.

We also believe that by providing financial services for workers, employers and workers can save time and money, and workers can begin to build savings, credit history and wealth.

This fall we’ll be launching the Ganaz Mastercard® Payroll Card. Much the way Gusto, the HR platform for small business, started with payroll and expanded into benefits and now financial services (and is now valued at a cool $4B), Ganaz is transforming the food and agriculture industry and the opportunities available to its millions of immigrant workers.

Workers are spending $1B on check cashing and remittances, and $2-3B billion on payday loans, overdraft fees, high interest loans, etc. But they aren’t the only ones losing money unnecessarily. Employers in food and agriculture are currently spending more than $400M per year to print and distribute paper checks.

By using the Ganaz Mastercard® Payroll Card, employers can save thousands of dollars and hundreds of hours per year that would otherwise be spent printing and distributing paper checks, and workers can save money on check cashing, keep their money in a safe place instead of under the mattress, and keep better control of their earning and spending. We’re leveraging our current tools to build a great experience for workers and employers:

Our texting infrastructure lets workers easily access their balance and transactions without a mobile app or data, and we’ll deliver accessible, relevant financial education via text as well

Our digital hiring tool is the system of record for employers, so we already have the employee data we need to make enrollment paperless, fast and worry-free for employers and workers

Our training tool will deliver easy-to-understand information about card benefits and how to use the card before enrollment

Ganaz will make money from merchants (stores pay an interchange fee) every time cardholders make a purchase and from ATM fees. Our out of network ATM fees ($1.75) will be lower than typical paycards, and we have a network of 37,000 ATMs that are totally free for cardholders to use. We’ll be building a low-cost, integrated remittance service into the card as well in late 2021 and early 2022.

There are so many ways to dramatically reduce the cost of financial services that this population bears, and build a great business in the process. This Andreessen Horowitz post articulates the opportunity for our business:

“By adding fintech, SaaS businesses can increase revenue per customer by 2-5x and open up new SaaS markets that previously may not have been accessible due to a smaller software market or inefficient customer acquisition...This wave is happening first in vertical markets (meaning the market around a specific industry, such as construction or fitness). Vertical software markets tend to have winner-take-most dynamics, where the vertical SaaS business that can best serve the needs of a specific industry often becomes the dominant vertical solution and can sell both software and financial solutions to their core customer base. ”

Ganaz Becomes A Public Benefit Corporation

With great opportunity comes great responsibility, so after research and discussion with the Ganaz board and staff, we decided to become a Public Benefit Corporation* with the specific public benefit purpose of leveraging technology to foster well being and prosperity for industry, workers and their communities. Ganaz has been mission-driven from the beginning, and, as we grow, we want to be sure that our mission remains front and center. This is a signal to potential employees, investors and partners that we care not only about building a large, profitable business, but we also will create a significant positive impact on the workers, businesses and communities we serve.

We made this move now since we are preparing to launch our first financial product for workers, and we know that financial services for the poor have a checkered history. We intend to build fair, helpful, and profitable financial products that help working families forge a path out of poverty. We want to be sure that as Ganaz grows, changes, and brings on new investors in our upcoming Series A and beyond, that the board has the duty to not only build shareholder wealth but to also fulfill our mission.

We are confident this move will keep us focused and help us grow fast. We are excited to follow in the footsteps of high-growth Public Benefit Corporations like PayActive (which just raised $100M) and ZenBusiness (which just raised $55M) to show the world that you can do very well by doing good.

We look forward to updating you later this year as we get closer to launching the Ganaz Mastercard® Payroll Card. Thank you for all your support and our best wishes for a happy and healthy 2021.

*Many people are familiar with B-Corps. A B-Corp is a certification that a Public Benefit Corporation can pursue if they choose. We have no plans to pursue B-corp certification. Here's a helpful comparison.

The Ganaz Mastercard® Payroll Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International.